Which Of The Following Is Not A Reason The Fed Changes The Rate Of Growth Of The Money Supply?

Introduction

The Fed, as the nation'south monetary policy authority, influences the availability and price of coin and credit to promote a healthy economy. Congress has given the Fed two coequal goals for budgetary policy: first, maximum employment; and, second, stable prices, significant low, stable aggrandizement. This "dual mandate" implies a third, bottom-known goal of moderate long-term interest rates.

The Fed'southward interpretations of its maximum employment and stable prices goals have changed over time as the economy has evolved. For example, during the long expansion after the Great Recession of 2007–2009, labor market place conditions became very strong and all the same did not trigger a significant rise in aggrandizement. Accordingly, the Fed de-emphasized its prior concern about employment possibly exceeding its maximum level, focusing instead only on shortfalls of employment below its maximum level. In this newer interpretation, formalized in the FOMC's August 2020 "Statement on Longer-Run Goals and Monetary Policy Strategy," high employment and low unemployment exercise not raise concerns for the FOMC equally long as they are not accompanied by unwanted increases in inflation or the emergence of other risks that could threaten attainment of the dual mandate goals.

More by and large, maximum employment is a wide-based and inclusive goal that is non directly measurable and is affected past changes in the construction and dynamics of the labor market place. So, the Fed doesn't specify a fixed goal for employment. Its assessments of the shortfalls of employment from its maximum level residual on a broad range of indicators and are necessarily uncertain. Intuitively, though, when the economy is at maximum employment, anyone who wants a task can become i. And recent estimates of the longer-run rate of unemployment that is consequent with maximum employment are by and large around 4 pct.

Fed policymakers approximate that a 2 percent inflation charge per unit, as measured by the annual change in the price alphabetize for personal consumption expenditures, is virtually consistent over the longer run with its mandate for stable prices. The Fed began explicitly stating the ii percent goal in 2012. In its 2020 "Statement on Longer-Run Goals and Monetary Policy Strategy," the FOMC changed that goal to aggrandizement that averages two percent over time, in contrast to aiming for ii percentage at any given time. So, following periods when aggrandizement has persisted below 2 percent, the Fed strives for inflation to be moderately above two per centum for some fourth dimension.

Setting Monetary Policy: The Federal Funds Rate

The federal funds rate is the interest rate that financial institutions charge each other for loans in the overnight market for reserves.

The Fed implements monetary policy primarily by influencing the federal funds charge per unit, the interest rate that financial institutions charge each other for loans in the overnight marketplace for reserves. Fed monetary policy deportment, described beneath, affect the level of the federal funds rate. Changes in the federal funds charge per unit tend to cause changes in other short-term interest rates, which ultimately bear on the price of borrowing for businesses and consumers, the total corporeality of money and credit in the economy, and employment and aggrandizement.

To keep price aggrandizement in check, the Fed can use its budgetary policy tools to raise the federal funds rate. Monetary policy in this instance is said to "tighten" or become more "contractionary" or "restrictive." To kickoff or reverse economic downturns and bolster inflation, the Fed can use its monetary policy tools to lower the federal funds rate. Budgetary policy is then said to "ease" or become more "expansionary" or "accommodative."

Implementing Monetary Policy: The Fed's Policy Toolkit

The Fed has traditionally used three tools to conduct monetary policy: reserve requirements, the discount rate, and open market operations. In 2008, the Fed added paying interest on reserve balances held at Reserve Banks to its monetary policy toolkit. More recently the Fed also added overnight reverse repurchase agreements to back up the level of the federal funds rate.

Reserve Requirements

The Federal Reserve Act of 1913 required all depository institutions to set aside a percentage of their deposits as reserves, to be held either as cash on hand or as account balances at a Reserve Bank. The Human activity gave the Fed the dominance to set that required percentage for all commercial banks, savings banks, savings and loans, credit unions, and U.S. branches and agencies of foreign banks. These institutions typically accept an account at the Fed and employ their reserve balances to see reserve requirements and to process financial transactions such as check and electronic payments and currency and coin services.

For most of the Fed's history, monetary policy operated in an environment of "deficient" reserves. Banks and other depository institutions tried to keep their reserves close to the bare minimum needed to run into reserve requirements. Reserves above required levels could be loaned out to customers. So, by moving reserve requirements, the Fed could influence the amount of bank lending. Promoting monetary policy goals through this aqueduct wasn't typical though.

Withal, reserve requirements have played a key office in the implementation of monetary policy. When reserves weren't very abundant, there was a relatively stable level of demand for them, which supported the Fed's ability to influence the federal funds rate through open market operations. The demand for reserves came from reserve requirements coupled with reserve scarcity. If a bank was at hazard of falling curt on reserves, it would borrow reserves overnight from other banks. Equally mentioned above, the interest rate on these short-term loans is the federal funds rate. Stable demand for reserves allowed the Fed to predictably influence the federal funds rate—the cost of reserves—by changing the supply of reserves through open market operations.

During the 2007–2008 financial crisis, the Fed dramatically increased the level of reserves in the cyberbanking system when it expanded its residual sheet (covered in more detail below). Since that time, monetary policy has been operating in an "ample" reserves environment, where banks have had many more reserves on manus than were needed to meet their reserve requirements.

In this ample reserves surroundings, reserve requirements no longer play the aforementioned role of contributing to the implementation of monetary policy through open market operations. In 2020, so, the Federal Reserve reduced reserve requirement percentages for all depository institutions to zero.

The Discount Rate

The discount rate is the interest rate a Reserve Bank charges eligible financial institutions to borrow funds on a short-term basis—transactions known as borrowing at the "discount window." The discount rate is set by the Reserve Banks' boards of directors, subject to the Board of Governors' approval. The level of the discount charge per unit is prepare above the federal funds charge per unit target. As such, the discount window serves as a backup source of funding for depository institutions. The discount window can too become the primary source of funds under unusual circumstances. An instance is when normal functioning of financial markets, including borrowing in the federal funds market place, is disrupted. In such a case, the Fed serves every bit the lender of final resort, one of the classic functions of a cardinal bank. This took place during the fiscal crisis of 2007–2008 (as detailed in the Financial Stability section).

Open Market Operations

Traditionally, the Fed's virtually oft used budgetary policy tool was open market operations. This consisted of buying and selling U.S. government securities on the open market, with the aim of aligning the federal funds rate with a publicly announced target set by the FOMC. The Federal Reserve Banking concern of New York conducts the Fed's open market place operations through its trading desk.

If the FOMC lowered its target for the federal funds rate, and then the trading desk-bound in New York would buy securities on the open market to increment the supply of reserves. The Fed paid for the securities by crediting the reserve accounts of the banks that sold the securities. Because the Fed added to reserve balances, banks had more reserves that they could and then catechumen into loans, putting more coin into apportionment in the economy. At the same fourth dimension, the increase in the supply of reserves put downward force per unit area on the federal funds rate co-ordinate to the basic principle of supply and demand. In turn, short-term and long-term market involvement rates directly or indirectly linked to the federal funds rate also tended to fall. Lower interest rates encourage consumer and concern spending, stimulating economical activeness and increasing inflationary pressure level.

On the other hand, if the FOMC raised its target for the federal funds rate, then the New York trading desk would sell regime securities, collecting payments from banks past withdrawing funds from their reserve accounts and reducing the supply of reserves. The decline in reserves put upward pressure on the federal funds rate, again according to the basic principle of supply and need. An increase in the federal funds charge per unit typically causes other marketplace interest rates to rise, which damps consumer and business organization spending, slowing economic activity and reducing inflationary pressure level.

Involvement on Reserves

The interest charge per unit paid on excess reserves acts like a floor beneath the federal funds rate.

As a result of the Fed's efforts to stimulate the economic system post-obit the 2007–2008 financial crisis, the supply of reserves in the banking organization grew very large. The amount is then large that most banks have many more reserves than they need to meet reserve requirements. In an environment with a superabundance of reserves, traditional open marketplace operations that change the supply of reserves are no longer sufficient for adjusting the level of the federal funds rate. Instead, the target level of the funds rate can be supported by irresolute the interest rate paid on reserves that banks hold at the Fed.

In Oct 2008, Congress granted the Fed the authority to pay depository institutions interest on reserve balances held at Reserve Banks. This includes paying involvement on required reserves, which is designed to reduce the opportunity toll of holding required reserve balances at a Reserve Bank. The Fed can also pay involvement on backlog reserves, which are those balances that exceed the level of reserves banks are required to hold. The involvement rate paid on excess reserves acts similar a floor beneath the federal funds rate considering most banks would not be willing to lend out their reserves at rates below what they can earn with the Fed.

Overnight Opposite Repurchase Agreements

The interest rate on reserves is a crucial tool for managing the federal funds rate. However, some financial institutions lend in overnight reserve markets but aren't allowed to earn interest on their reserves, then they are willing to lend at a rate below the interest on reserves rate. This primarily includes regime-sponsored enterprises and Federal Home Loan Banks.

To account for such transactions and support the level of the federal funds rate, the Fed likewise uses financial arrangements called overnight reverse repurchase agreements. In an overnight opposite repurchase agreement, an institution buys securities from the Fed, and then the Fed buys the securities back the next mean solar day at a slightly college cost. The institution that bought the securities the day before earns interest through this process. These institutions have petty incentive to lend in the federal funds marketplace at rates much beneath what they tin earn by participating in a reverse repurchase agreement with the Fed. Past changing the interest charge per unit paid in reverse repurchase agreements, in addition to the rate paid on reserves, the Fed is able to better command the federal funds rate.

In December 2015, when the FOMC began increasing the federal funds rate for the first time after the 2007–2008 financial crisis, the Fed used interest on reserves, every bit well every bit overnight reverse repurchase agreements and other supplementary tools. The FOMC has stated that the Fed plans to use the supplementary tools only as they are needed to assist control the federal funds charge per unit. Interest on reserves remains the master tool for influencing the federal funds rate, other market interest rates in turn, and ultimately consumer and business borrowing and spending.

Nontraditional and Crisis Tools

When faced with severe disruptions, the Fed can plough to additional tools to support financial markets and the economy. The recession that followed the 2007–2008 financial crunch was so severe that the Fed used open up market operations to lower the federal funds rate to near null. To provide additional support, the Fed also used tools that were non part of the traditional toolkit to lower borrowing costs for consumers and businesses. I of these tools was purchasing a very big amount of assets such equally Treasury securities, federal bureau debt, and federal bureau mortgage-backed securities. These nugget purchases put boosted down force per unit area on longer-term interest rates, including mortgage rates, and helped the economic system recover from the deep recession. In improver, the Fed opened a series of special lending facilities to provide much-needed liquidity to the financial system. The Fed likewise announced policy plans and strategies to the public, in the class of "frontwards guidance." All of these efforts were designed to assistance the economy through a difficult period.

Recently, the Fed responded to the COVID-xix pandemic with its total range of tools, to support the flow of credit to households and businesses. This included both traditional tools and an expanded set up of non-traditional tools. The traditional tools included lowering the target range for the federal funds rate to near zippo and encouraging borrowing through the disbelieve window, in improver to lowering the discount rate and increasing the length of fourth dimension available to pay back loans. On the not-traditional side, the Fed purchased a large amount of Treasuries and agency mortgage-backed securities, and opened a set of lending facilities nether its emergency lending potency that is even broader than what was established during the crisis a dozen years earlier. These tools are designed to back up stability in the financial system and bolster the implementation of monetary policy by keeping credit flowing to households, businesses, nonprofits, and land and local governments.

The Fed's Balance Canvass

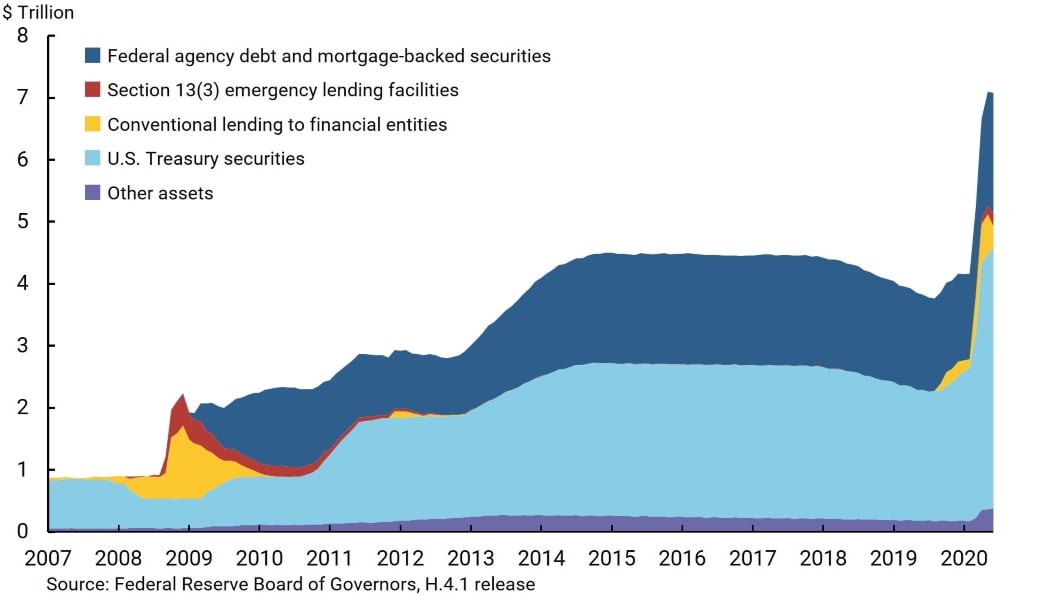

A nautical chart of the Fed'due south rest sheet is available below and provides details on v wide categories of assets, including 1) U.Due south. Treasury securities; 2) federal agency debt and mortgage-backed securities; 3) conventional lending to fiscal entities; four) emergency lending facilities authorized under Department 13(iii) of the Federal Reserve Act; and five) other assets.

As shown in the chart, the Fed's balance canvas has expanded and contracted over fourth dimension. During the 2007–08 fiscal crisis and subsequent recession and recovery, total assets increased significantly from approximately $870 billion before the crisis to $4.5 trillion in early 2015. Then, reflecting the FOMC's rest sheet normalization program that took place between Oct 2017 and August 2019, total avails declined to under $3.eight trillion. Starting time in September 2019, total avails started to increase again, reflecting responses to disruptions in the overnight lending market. The most recent increase, beginning in March 2020, reflects the Fed'south efforts to back up financial markets and the economy during the COVID-19 pandemic.

Federal Reserve Balance Canvas Avails

Sources:

Factors Affecting Reserve Balances – H.4.1, Federal Reserve Board of Governors, July 9, 2020.

FAQs: Money, Interest Rates, and Monetary Policy, Federal Reserve Lath of Governors, March 1, 2017.

Federal Reserve Printing Release: Decisions Regarding Monetary Policy Implementation, Dec 16, 2015.

Federal Reserve Press Release: Federal Reserve Deportment to Support the Flow of Credit to Households and Businesses, March 15, 2020.

Federal Reserve Printing Release: FOMC argument of longer-run goals and policy strategy, January 25, 2012.

Federal Reserve Press Release: Interest on Reserves, October 6, 2008.

Federal Reserve Press Release: Policy Normalization Principles and Plans, September 17, 2014.

The Federal Reserve System Purposes & Functions, Federal Reserve Board of Governors, Tenth Edition, October 2016.

Federal Reserve's Exit Strategy, testimony past Ben S. Bernanke, Chairman, Federal Reserve Board of Governors, before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C., March 25, 2010.

The Federal Reserve'due south Policy Actions during the Financial Crisis and Lessons for the Future, speech by Donald L. Kohn, Vice Chairman, Federal Reserve Board of Governors, at the Carleton University, Ottawa, Canada, May 13, 2010.

FedPoints: Federal Funds and Interest on Reserves, Federal Reserve Banking concern of New York, March 2013.

FedPoints: Open up Marketplace Operations, Federal Reserve Banking concern of New York, August 2007.

Guide to changes in the Statement on Longer-Run Goals and Monetary Policy Strategy, Federal Reserve Lath of Governors, Baronial 27, 2020.

Monetary Policy 101: A Primer on the Fed'south Changing Arroyo to Policy Implementation, by Jane E. Ihrig, Ellen Due east. Meade, and Gretchen C. Weinbach, Federal Reserve Board of Governors, Finance and Economics Discussion Series 2015-047, June 30, 2015.

Reserve Requirements, Federal Reserve Lath of Governors, March 20, 2020.

Review of Monetary Policy Strategy, Tools, and Communications—Q&As, Federal Reserve Board of Governors, Baronial 27, 2020.

Statement on Longer-Run Goals and Monetary Policy Strategy, Federal Reserve Lath of Governors, August 27, 2020.

Summary of Economic Projections, Federal Reserve Lath of Governors, June 10, 2020.

Source: https://www.frbsf.org/education/teacher-resources/what-is-the-fed/monetary-policy/

Posted by: pullumthempling.blogspot.com

0 Response to "Which Of The Following Is Not A Reason The Fed Changes The Rate Of Growth Of The Money Supply?"

Post a Comment